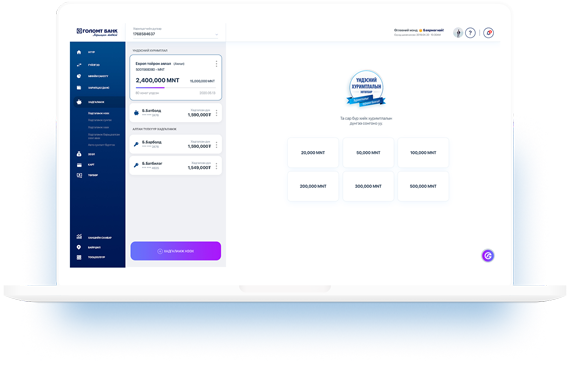

ACCESS ALL TYPES OF BANKING SERVICES ONLINE

Internet banking (www.egolomt.mn) allows you to access all types of banking services from any device connected to the internet regardless of space and time.

Products and service

Open and close a current account

Open a term deposit account

Open and renew a savings account

Order, renew and replace a debit card

Get savings backed loan

Get a digital loan

Close a loan account

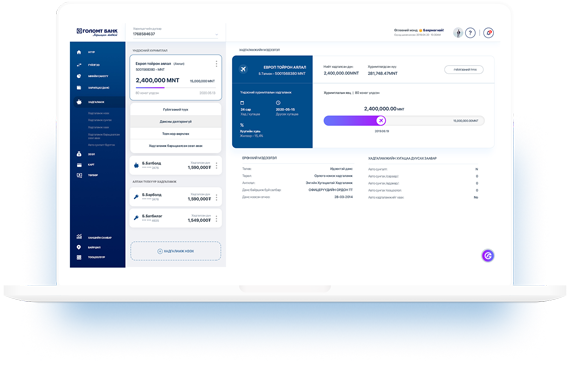

Monitor your finance

Register for and extend “Easy Info”

Non-cash settlements

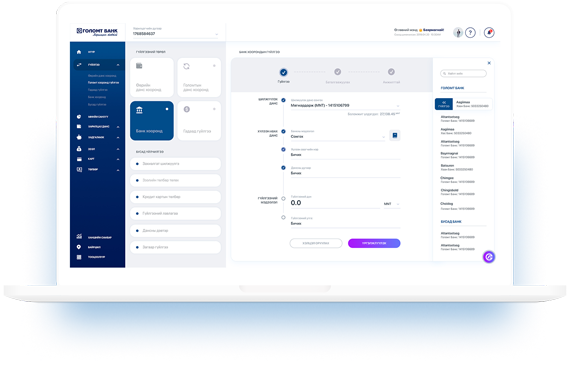

Make an intrabank and between your account transfer

Make an interbank transfer

Loan payment

Billing

Mobile top-up

Customs payment

Pay traffic fines

Tax payment

Savings backed loan payment

Credit card payment

Make foreign bank /SWIFT Western Union/ transfer

Others

Block the card

Get an e-code

E-barimt auto registration

View account statement

View account balance

Change account nickname

Create a transaction rule

View transaction list

Change internet banking username and password

View credit card and other loan repayment schedule

View loan graphic

Annual fee - Free of change

Daily transaction limit - Up to 20-500 million MNT /Transfers between own account, Loan payment, Billing, Customs payment, Tax payment and Traffic fine payment are not subject to daily transaction limit/

Intrabank - 100 MNT /Transfers between own account, Credit card payment, Loan payment, Billing, Customs payment are not subject to fee/

Interbank transfer fee - Up to 5,000,000 MNT – 200 MNT

- Over 5,000,001 MNT and foreign currency transaction regardless of transaction amount – 400 MNT

- Foreign currency – 400 MNT

Foreign bank transfer fee - According to general terms and conditions

E-token device price Starting from April 1, 2024, the selling price to customers is 120,000 MNT. It consists of: - Price of the device: 80,000 MNT /One time/

- License price: 40,000 MNT /every year/

Account reference via online - Fee – 1000MNT

- Please visit your nearest branch with your ID card in order to register for internet banking.

- Use the “Online Registration” menu on the Internet Bank Login page.

- Can I pay apartment bill from Internet banking?

Yes. You can make a payment by checking that your Condominium association is registered by accessing the “Billing” submenu of the “Payment” main menu of Internet Banking.

- Is there a service to order the card PIN code from internet banking?

You can get a card PIN code through the “Get a PIN code” section from the “Card” main menu of Internet banking.

- Is it possible to order a credit card from internet banking?

You can only order a debit card using internet banking.

- Can I repay my loan through Internet banking? Can I repay my loan in advance?

Yes. You can repay the loan through the “Loan Repayment” section of the “Loan” main menu of the Internet Banking.

- Is it possible to renew all types of deposits through Internet banking?

Only term deposits and savings for accumulation can be extended through Internet banking. If the other term deposits are extended, the deposits will be extended as a regular term deposit.

- Can I cancel my deposit through Internet banking?

Yes. You can close your savings account according to the instructions using the “Close Savings” submenu of the “Savings” main menu of Internet Banking.

- What is an e-token?

An e-token is a device that generates a one-time password (changed every 40 seconds). Using this device will increase the customer’s account information, transaction confidentiality and security.

- – How long does it take for the interbank transfer to credit in the beneficiary’s account?

Large-value (above 3 million MNT) transfers between banks are made on weekdays between 9am – 4pm. Transfers made after 4pm will be transferred on the next week day between 9am – 11am.

- Can a customer who has opened an account online make a transaction from that account? Is internet banking included?

Yes, internet banking is included. However, an online account right only allows you to make transactions between your own accounts.

- How many years is internet banking valid for?

Standard right, limited right, and Online right for Internet Banking are indefinite, while Special right agreement is valid for a period of a year.

- Can I pay apartment bill from Internet banking?

- How to register for Internet banking services?

You can register for internet banking through one of the following two channels:

- Use the “Online Registration” menu on the Internet Bank Login page

- Pick up your ID and register at any branch or settlement near you

- Can a 16-year-old sign up for Internet banking?

Customers who are 18 years of age or older are not eligible to register for Internet banking.

- What are the advantages?

New features:

- Open and close accounts

- Deposit renewal and closing

- Debit card replenishment and renewal

- Card blocking

- Get a digital loan

- View loan schedules

- Add Budget and Categories through My Finance menu, Edit Transaction Categories, Filter and Separate Transactions, Create Transaction Rules

- Get an online reference

Advantages:

- Savings, Credit and Card menu with more additional services

- Artificial Intelligence-Based Transaction and Payment Shortcuts

- My Finance menu, an automated browser that manages your finances

- Simplified Consumer Payment Calendar

- Online reference service for obtaining and verifying account information

- Alert service to deliver necessary information to customers

- Help menu to help you use Internet banking

- Updated Location menu to show branches load

- What is the difference between a new internet bank and an old internet bank?

Updated Internet banking is:

- Based on artificial intelligence, customer behavior and consumption

- Innovative colors, designs and textures

- Contains more additional products and services (for example, you can pay the loan through the “Loan Repayment” submenu of the “Loan” main menu of the Internet Banking without visiting the branch)

- Бизнес үйлчилгээ

- Can a customer who has opened an account online make a transaction from that account? Is internet banking included?

Yes, internet banking is included. However, an online account right only allows you to make transactions between your own accounts.

- How to register for Internet banking services?

You can register for internet banking through one of the following two channels:

- Use the “Online Registration” menu on the Internet Bank Login page

- Pick up your ID and register at any branch or settlement near you

- Can a 16-year-old sign up for Internet banking?

Customers who are 18 years of age or older are not eligible to register for Internet banking.

- What is the difference between a new internet bank and an old internet bank?

Updated Internet banking is:

- Based on artificial intelligence, customer behavior and consumption

- Innovative colors, designs and textures

- Contains more additional products and services (for example, you can pay the loan through the “Loan Repayment” submenu of the “Loan” main menu of the Internet Banking without visiting the branch)

- How to register for Internet banking services?

This website uses google analytics

This website uses information gathering tool which is Google analytic in order to determine the effectiveness of our online campaign in terms of sales and user activity on our sites.